Discovering the Benefits and Threats of Purchasing Cryptocurrencies

The landscape of copyright investment is defined by a complex interaction of engaging advantages and considerable threats. While the appeal of high returns and portfolio diversity is enticing, possible capitalists need to browse fundamental difficulties such as market volatility and governing ambiguities. Comprehending these dynamics is essential for any individual taking into consideration access into this unpredictable arena. As we additionally analyze the nuances of copyright investment, it becomes apparent that notified decision-making is extremely important; nonetheless, the question remains: How can financiers properly balance these benefits and threats to safeguard their financial futures?

Understanding copyright Fundamentals

As the electronic landscape progresses, understanding the essentials of copyright comes to be crucial for prospective financiers. copyright is a form of electronic or digital currency that uses cryptography for protection, making it challenging to fake or double-spend. The decentralized nature of cryptocurrencies, generally developed on blockchain technology, boosts their safety and transparency, as deals are videotaped throughout a distributed journal.

Bitcoin, created in 2009, is the very first and most well-known copyright, however thousands of options, called altcoins, have actually arised since after that, each with unique attributes and purposes. Capitalists ought to familiarize themselves with vital ideas, consisting of purses, which store private and public secrets required for deals, and exchanges, where cryptocurrencies can be acquired, sold, or traded.

Furthermore, understanding the volatility related to copyright markets is crucial, as prices can vary considerably within short durations. Regulatory factors to consider also play a significant duty, as different countries have varying stances on copyright, affecting its usage and approval. By realizing these fundamental elements, possible financiers can make educated choices as they browse the complex globe of cryptocurrencies.

Key Benefits of copyright Financial Investment

Buying cryptocurrencies offers a number of compelling benefits that can bring in both beginner and experienced investors alike. One of the key benefits is the capacity for substantial returns. Historically, cryptocurrencies have actually shown remarkable rate admiration, with very early adopters of properties like Bitcoin and Ethereum realizing significant gains.

One more secret benefit is the diversity chance that cryptocurrencies offer. As a non-correlated property class, cryptocurrencies can function as a hedge against traditional market volatility, allowing capitalists to spread their risks across different investment cars. This diversification can enhance overall portfolio efficiency.

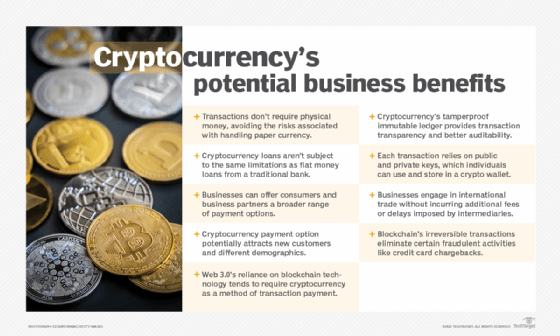

Additionally, the decentralized nature of cryptocurrencies provides a level of autonomy and control over one's assets that is usually lacking in conventional financing. Investors can manage their holdings without intermediaries, potentially lowering costs and raising openness.

In addition, the growing acceptance of cryptocurrencies in mainstream financing and business even more strengthens their worth suggestion. Several businesses currently accept copyright repayments, leading the way for broader adoption.

Last but not least, the technical innovation underlying cryptocurrencies, such as blockchain, offers possibilities for investment in arising fields, consisting of decentralized money (DeFi) and non-fungible tokens (NFTs), enriching the financial investment landscape.

Major Risks to Think About

Another important danger is regulative uncertainty. Governments all over the world are still developing policies pertaining to cryptocurrencies, and changes in regulations can drastically impact market characteristics - order cryptocurrencies. An undesirable regulatory environment can restrict trading or also lead to the banning of particular cryptocurrencies

Protection risks likewise pose a considerable danger. Unlike traditional financial systems, cryptocurrencies are susceptible to hacking and fraud. Investor losses can happen if exchanges are hacked or if private tricks are compromised.

Lastly, the lack of consumer securities in the copyright space can leave investors at risk - order cryptocurrencies. With minimal option in case of scams or theft, individuals may locate it challenging to recover shed funds

Due to these threats, extensive study and risk evaluation are vital before taking part in copyright investments.

Strategies for Effective Spending

Creating a durable strategy is vital for navigating the complexities of click for source copyright financial investment. Financiers ought to start by conducting comprehensive research to recognize the underlying innovations and market characteristics of various cryptocurrencies. This consists of staying notified regarding patterns, regulative developments, and market belief, which can dramatically affect property efficiency.

Diversity is another crucial approach. By spreading investments throughout numerous cryptocurrencies, investors can mitigate dangers connected with volatility in any solitary possession. A healthy portfolio can give a barrier against market changes while enhancing the capacity for returns.

Establishing clear investment objectives is crucial - order cryptocurrencies. Whether going for temporary gains or long-lasting wealth buildup, defining particular purposes assists in making notified choices. Executing stop-loss orders can additionally shield financial investments from significant recessions, enabling a self-displined exit strategy

Lastly, constant surveillance and review of the investment method is essential. The copyright landscape is vibrant, and on a regular basis assessing efficiency versus market conditions ensures that investors remain agile and receptive. By sticking to these methods, capitalists can improve their chances of success in the ever-evolving world of copyright.

Future Trends in copyright

As financiers improve their techniques, recognizing future trends in copyright ends up being significantly important. The landscape of electronic money is progressing quickly, affected by technical advancements, governing advancements, and shifting market dynamics. One considerable pattern is the surge of decentralized finance (DeFi), which aims to recreate conventional monetary systems using blockchain modern technology. DeFi methods are obtaining traction, offering ingenious monetary products that might reshape exactly how people engage with their properties.

An additional arising fad is the growing institutional passion in cryptocurrencies. As firms and banks adopt digital money, mainstream acceptance is likely to raise, potentially causing greater cost security and liquidity. Additionally, the assimilation of blockchain modern technology into various industries mean a future where cryptocurrencies work as a foundation for deals throughout fields.

In addition, the governing landscape is developing, with governments looking for to create frameworks that balance innovation and customer security. This regulative clearness could foster a more secure financial investment setting. Last but not least, developments in scalability and energy-efficient consensus devices will certainly attend to problems bordering deal speed and environmental impact, making cryptocurrencies much Check This Out more practical for everyday use. Comprehending these trends will certainly be crucial for capitalists wanting to navigate the complexities of the copyright market efficiently.

Verdict